Are mobile networks dying? How Starlink’s direct-to-cell is changing the game

Mobile communications are entering a period of dramatic change, fueled by swift progress in satellite technology. For decades, terrestrial cell towers have formed the foundation of mobile networks, delivering service to cities, suburbs, and portions of the countryside. Now, with satellite connectivity advancing rapidly, a question arises: Could satellites take the place of cell towers in the mobile network of the future? Will I even need my typical mobile operator? Could the days of waving your phone around toward the sky, searching for a bar of signal, finally be over?

While the vision of a fully space-based communications grid is intriguing, the truth is more complex. Let’s unpack the tech, the players, and the stakes.

A look back on SAT phones

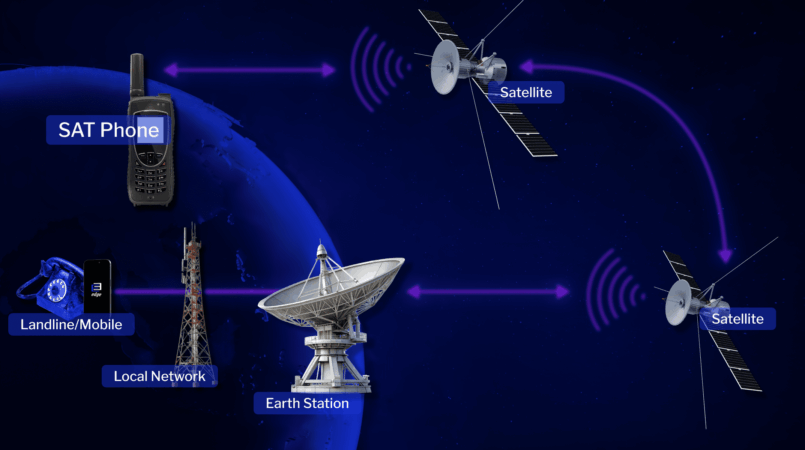

Today we all see Starlink as the main focus for the term satellite phone, but did you know they weren’t the ones who invented it? The term satellite phone (SAT) goes way back! Satellite phones were first conceptualized about half a century ago, in the 1970s, when space agencies began strategizing with telecommunications companies to enhance global communication using satellite technology. While none of the early-stage satellite phones were meant to be available for commercial use, they were aimed at military and research applications.

Well, they were aimed to be used in military and scientific research, but SAT phones are still also increasingly used for nefarious purposes, typically by people in criminal or drug trafficking organizations, as such phones can fly under the law’s radar or bypass local and regional policies and regulations.

Pic.1. Satellite phone communication flow diagram

Satellite phones first became commercially available in the late 1990s, marking a breakthrough in global communications. A defining moment came when Iridium Communications launched a constellation of over 60 satellites, enabling voice coverage almost anywhere on Earth. However, this technology came at a steep price — handsets started around $1,300, and calls could cost as much as $7 per minute. Despite investing nearly $5 billion to build and launch the network, Iridium struggled to attract more than 55,000 subscribers.

In the early 2000s, satellite phone technology became more accessible and more advanced. But it was the 2010 to 2020 where even bigger innovations were made. Satellite phones have become compatible with smartphones, and smartphone technology could be integrated with satellite-driven capabilities. Inmarsat and Thuraya were two of the biggest players continuing development, although more entities were making their debut during this time.

Today we are speaking about such companies like SpaceX, OneWeb and Telesat that have continued the though of SAT phones. Although one thing has changed, all of the listed companies have their SAT phone as a operating constellation of small satellites in Low Earth Orbit (LEO). Since these companies operate in space with a narrowed scope of focus, they are able to innovate and provide even better coverage and reliability than companies in the past.

What is SpaceX Starlink direct to cell service?

In short, Starlink is the technology owned by SpaceX, which provides ubiquitous global connectivity by eliminating traditional mobile dead zones through satellite-to-mobile technology. So basically, you can contact a person even if he is hiking on mount Everest. Currently Starlink operates the world’s largest satellite constellation, with more than 9528 satellites currently in orbit, serving millions of active customers around the globe.

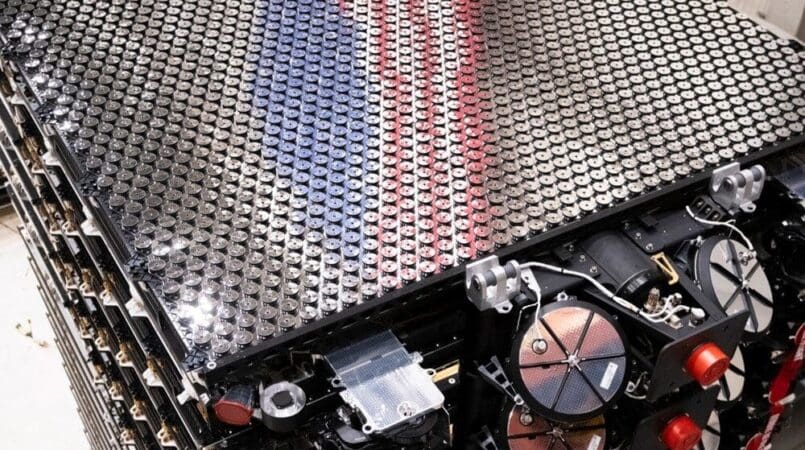

Pic.2. Stack of Starlink satellites before deployment

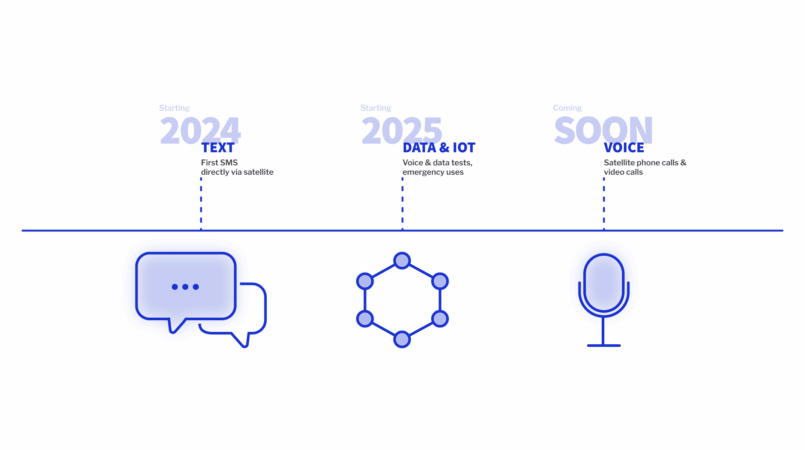

Starlink’s direct to cell or D2C service has been rolled out in a number of countries and is already a game-changer: it lets your phone connect directly to satellites without Wi-Fi or extra gear. Starlink has partnered with several mobile carriers worldwide for its Direct to Cell service and as of August 2025 it is already available in 100+ countries.

For example one place where D2C is already actively used is war in Ukraine. Since the full‐scale Russian invasion in February 2022, Starlink has played a critical role in maintaining Ukraine’s connectivity when terrestrial networks have failed. After Ukraine’s government requested SpaceX to activate Starlink services, the first terminals were delivered in late February 2022, just days after the invasion began. At that time, the internet connection was fairly good, but already then it was expected to deteriorate as the conflict worsens. These terminals have been used both by civilians—especially in areas where power, internet, and cell services have been disrupted—and by the military, for secure communications, coordination of drone and reconnaissance operations, and real-time artillery targeting.

How does it work?

So how does it work? and actually why do they need so many satellites? Each of the satellites are about 100 to 500kg in mass and all of them use.

- optical inter-satellite communications – laser beams used for satellite talk, this allows data to travel from one satellite to another through space

- digital processing technology in the Ku and Ka bands – onboard computers manage and route the signals received in these microwave spectrum bands (Ku ~12–18 GHz, Ka ~26–40 GHz), instead of just “bouncing them back” like standard satellites do

- phased array beamforming – flat panel of many small antennas that can “steer” radio beams electronically.

Starlink’s Direct-to-Cell service is designed to let ordinary smartphones connect directly to satellites in orbit without the need for extra equipment. It works by equipping Starlink’s second-generation satellites with large phased-array antennas that can transmit and receive signals in the same radio frequencies (LTE/4G bands) that regular phones already use to connect to cell towers. When a person is in an area without terrestrial coverage, their phone can “see” a Starlink satellite in the sky and connect to it just as if it were connecting to a very tall, space-based cell tower. Once the signal reaches the satellite, it doesn’t go straight to the internet in space; instead, the satellite relays that signal down to a Starlink ground station (also called a gateway), which is connected to the global fiber-optic backbone of the internet. From there, if the user is making a phone call or sending an SMS, the traffic is handed off to the partner mobile network operator’s core infrastructure (for example, T-Mobile in the U.S.).

Pic.3. Starlink system explained

Because this system uses existing cellular protocols, phones don’t need hardware modifications or special antennas, though coverage and bandwidth are limited at first, as each satellite can only handle a small number of simultaneous connections compared to terrestrial towers. Over time, as more satellites with direct-to-cell payloads are launched, coverage and capacity will improve, eventually enabling text, voice, and data services globally.

Starlink popularity

But you know Starlink is not the only one in this competition of providing connectivity via satellites. There is Oneweb, Amazon Kuiper, Viasat which all are targeting this new thriving market. So why we mostly speak about SpaceX Starlink? Well SpaceX edges past everyone because of the following points:

- they employ thousands of tiny satellites rather than a few huge ones

- they have satellites at only 550km above the sea level

- satellites contain laser communication parts that allow signals to be sent between satellites – this minimizes reliance on several ground stations

- in future they plan on having 40000 satellites and their markets is based on a everyday user not just governments or corporations

- they have frequent voyages to space, as SpaceX has such advantage for building and launching its own rockets

Pic.4. Starlink timeline

Starlink’s global competitors in satellite internet

So we know that Starlink is not the only one in the battle for the sky. There are its competitors and alternatives. From the already mentioned Oneweb, Amazon Kuiper and Viasat, there are also Hughes Network Systems, Telesat Lightspeed, SES S.A., Inmarsat, NBN Sky Muster, EchoStar Mobile, AST SpaceMobile and Telstra Satellite Internet – so quite the few.

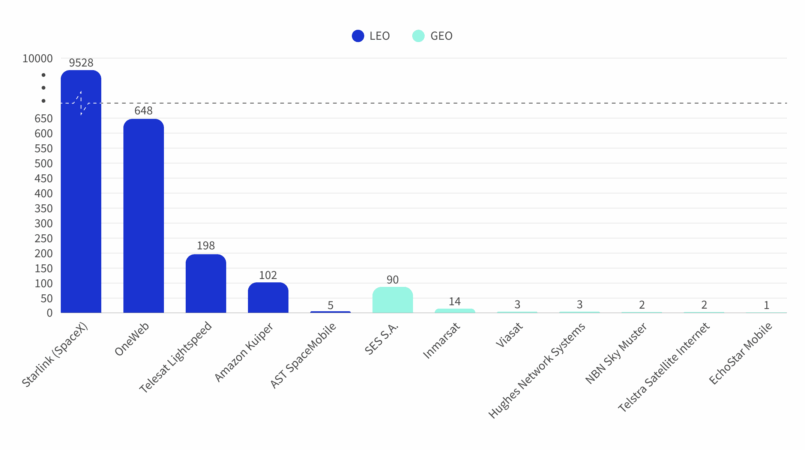

Pic.5. Comparison of satellite internet providers by current operational satellites (2025, approx)

The diagram clearly shows Starlink’s massive lead in current satellite constellations. OneWeb is the next in line with about “648 satellites in LEO by 2022. Amazon Kuiper currently has 102 satellites, that were launched by 4 missions with SpaceX Falcon 9. Their initial plan is to have 3200 spacecrafts. Telesat exceeds Amazon current count by 96, totaling it to 198 satellites. AST SpaceMobile at the start of August 2025 shared their business results and explained that they will invest 1.5 billion to have up to 60 satellites by the end of 2026 and 243 in the long run. All other satellite internet providers operate in GEO with less spacecrafts than the already mentioned companies, except for SES S.A., which has 90 GEO satellites.

LEO (Low Earth Orbit) satellites altitude from earth is 500-2000km, which makes the latency at about 20-40ms. Whereas GEO (Geostationary Orbit) is ~35786km from Earth and has a latency at about 600ms – noticable lag in conversations, video calls or online games.

Disadvantages of direct to cell service

As we have listed all of the things that make direct to cell a great option, we do also need to know the downsides:

- currently very low data speed: today the D2C cannot be a replacement to our traditional mobile carriers in terms of speed or capacity. Initial services are text-only or very low bitrate. For instance, Chinese direct satellite calls run at 800 bps (only enough for voice), current D2C is only few Mbps.

- has a requirement for a clear sky: unfortunately the service does not work indoors, underground or in dense urban canyons reliably. Satellite signals are easily blocked by solid objects. Traditional satellite phones often have external antenna dongles for use in vehicles or require you to step outside. Similarly, for your normal phone to catch a satellite, you’ll likely need to be outdoors or at least by a window with a clear sky view.

- D2C drains your phone battery A LOT: communication with a satellite is not the same, it drains more power. Of course, phone also doesn’t “listen” to the satellite constantly unless needed, to save power

- regulatory and spectrum challenges: this is not a user based criteria, but still is a clear disadvantage of D2C. What does this mean? Using cellular spectrum from space requires regulatory approval country by country. Spectrum that a carrier owns terrestrially isn’t automatically allowed for satellite use – some countries have moved quickly, but others are still updating laws.

- competitors and their compatibility: as listed Starlink is not the only one with direct to cell service. So if you for example have Starlink and you friend has AST SpaceMobile, will your phones be able to talk via satellite when roaming? Possibly yes if roaming agreements are in place (as with Starlink’s partner network). But it’s conceivable some regions might favor one over the other.

Though maybe the downsides will not remain for long, as D2C service providers and their partner mobile operators are working to have the D2C fully accessible in near future.

The dark side of direct-to-smartphone service

Okay, a bit more on the downsides – as many things, with the positive side there are always a negative aspect. At the beginning in this article we already stepped a foot in the door of the communication for illicit purposes using satellite phones. As the area of Starlink usage is growing and it can be used from our standard phones, we can also expect the dark side of this communication to be more advanced.

The first time a Starlink’s device had been used on a criminal basis was at the end of 2024 in India, when drug smugglers who used Starlink’s satellite internet device to navigate deep sea brought meth worth $4.25 billion into Indian waters. The smugglers were reportedly using a Starlink Mini satellite internet device to navigate at sea and create a Wi-Fi hotspot for communication purposes.

This smuggler action arises a question – if Starlink works with our standard phones through national mobile carriers, how this incident could have happened? At the time, Starlink isn’t officially licensed to operate in India. Its coverage in Indian territorial waters is contingent on government approval. However, international waters, where the smugglers started their journey, are not governed by Indian telecom regulations—so devices like the Starlink Mini can legally function there.

Starlink has faced criticism for its misuse in cases like drug smuggling in India, but SpaceX is taking steps to address these risks. The company’s terms of service already prohibit illegal use, and authorities in countries such as India are requiring Starlink to share purchase and usage data of seized devices.

So what’s next for Starlink? Are mobile networks really dying?

The future of Starlink’s direct to cell service looks increasingly ambitious and technologically promising. The FCC has also approved Starlink’s partnership with T-Mobile to operate its D2C service at higher power levels, which should help improve signal strength, coverage, and reliability, especially in challenging or remote environments. Meanwhile, Starlink themself are preparing its next generation of satellites (so called V3 or third generation units), expected to begin launching in the first half of 2026, each with gigabit level throughput. According to crowdsourced measurements and academic studies, the current D2C beta phases offer relatively modest data speeds under about 4 Mbps outdoors, but projections suggest that with sufficient satellite density, spectrum access, and regulatory power limits, those speeds could rise to about 24 Mbps per user beam.

All of that being said, the question of Starlink is a competitor to mobile operators can be easily explained: currently they largely work hand in hand. Starlink’s direct to cell service depends on partnerships with mobile operators (which own spectrum and regulation rights), and until September 2025 SpaceX was leasing or using carrier-owned spectrum for many D2C operations. With its recent purchase of AWS-4 and H-block licenses from EchoStar, Starlink is moving toward owning more of its spectrum, which could reduce dependence on others.

That said, D2C is unlikely to fully supplant today’s mobile networks: terrestrial networks still offer much higher capacity, better indoor performance, and lower latency in populated areas. As well, why should we use and have only Starlink that works very slow compared to todays 5G? Costs as well are incomparable as mobile carriers are much cheaper. Starlink will probably remain a complementary service, especially valuable in rural or infrastructure-poor regions, rather than a full replacement.

Conclusions

So no, mobile networks aren’t dying, and they won’t be any time soon. What’s happening instead is a reshaping of the connectivity landscape, where satellite systems like Starlink D2C fill in the gaps that traditional terrestrial 4G/5G networks can’t cover. Because lets keep in mind that up to now still approximately 50% of the world still does not have access to the internet!

In cities and towns, terrestrial mobile networks will continue to dominate thanks to their speed, density, and cost efficiency. But in remote villages, at sea, or during disasters, satellites provide a critical safety net. Rather than replacing carriers, Starlink and other constellations are becoming powerful partners to them, ensuring that in the future there would be no waving your phone towards the sky to catch some coverage.