Cisco 100g CPAK transceiver availability?

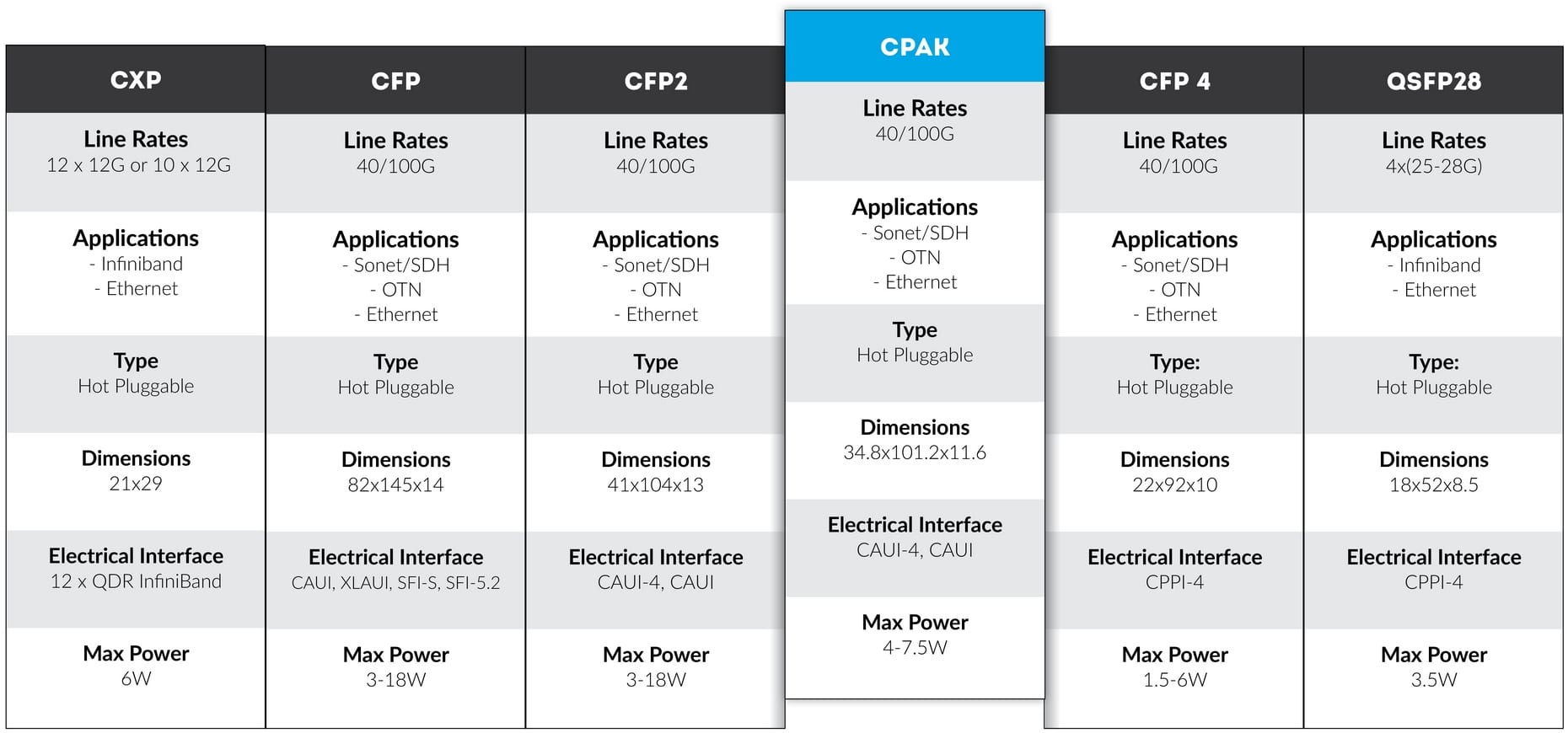

On March 2013 Cisco announced launch of it’s proprietary 100G optical transceiver module called CPAK. Unless other pluggable optic form-factors like XFP, SFP+, QSFP, CFP, CFP2/4 with are industry standard (Multi-Source Agreement MSA), CPAK is totally Cisco proprietary.

What makes CPAK Different?

CPAK was first transceiver using CMOS Photonics also called silicon photonics. CMOS stands for Complementary metal–oxide–semiconductor and it is semiconductor technology controlling flow of photons in place of electrons. CMOS/Silicon photonics is technology, where consonance between two industries gives some synergy, mainly leveraging on huge investment already made in semiconductor manufacturing. What does this gives to networking – mainly two main aspects where CPAK has advantage – first footprint, at it’s launch date it had smallest 100G footprint providing higher port density and energy economy – according Cisco marketing material from 4W to 7.5W per module.

What about Competition?

CPAK were launched in days when CFP2 was a bit late in market, but now for 100G application equipment vendors have rich selection of interface modules, including also CFP4 and QSFP28 with both has smaller footprint and smaller energy consumption – in such way eliminating both unique selling points of CPAK module. True – CFP4 and QSFP28 modules are produced using legacy VSCEL laser technology, but same time Photo electronic vendors as Finisar and others are showcasing their silicon photonic based prototypes.

Juniper Networks recently introduced its 1TB line card on PTX with CFP2 pluggable optics. According their opinion fact that such leading photo electronic producers as Sumitomo, Finisar, JDSU, and Avago has backed up open source CFP2 standard is good evidence of it’s future potential.

Influence of CPAK?

Currently I tend to think that CPAK as form factor has more con’s then pros. There are open source MSA compatible 100G products like CFP/2/4 and QSFP28 with same or better performance as CPAK. Main thing networkers should care is open source versus proprietary aspect. Every time when new pluggable optics form factors have been released, their initial prices were fortune. But as most of them are MSA Open-Source products, industry quickly adopts and 3rd party optical solution vendors as ourselves helps market to drive down this pricing and save huge costs for service providers, operators and data centers, as optical pluggables are 15-30% of active equipment CAPEX. In case of proprietary CPAK technology networkers risk to be locked-in situation, where they can get these modules only from one source, with is protecting it’s margins and not going down as fast industry is. I even think that such situation can backfire on Cisco, in cases of close competition they can simply lose to other – more open source platforms.

When CPAK will be available from 3rd party vendors?

I honestly do not know. It depends mainly on two factors – first, if Cisco will release rights for other industry manufacturers produce compatible CPAK transceivers and second, when they do so – will industry be willing to produce them, as we need to take in consideration potential market size. Maybe MSA standard modules will out-compete CPAK? Anyhow – our customers will be ones of first to know update, if such industry development will take place!